12 - offroad, How to set up the parameters, 12 – offroad – Gasboy CFN III Config Mnl V3.4 User Manual

Page 93

MDE-4316C CFN Series CFN III Configuration Manual for Windows NT® · April 2007

Page 87

Offroad

12 – Offroad

OFFROAD.BIN is a disk-based configuration program that calculates an offroad tax discount

for a payable fuel sale (sale must be postpay and payable) and adds a refund item to the sale in

the amount of the discount. Information for OFFROAD.BIN comes from the data or config

file OFFROAD.DTA. You will need to edit the file OFFROAD.DTA to set up the tax

parameters.

How to Set Up the Parameters

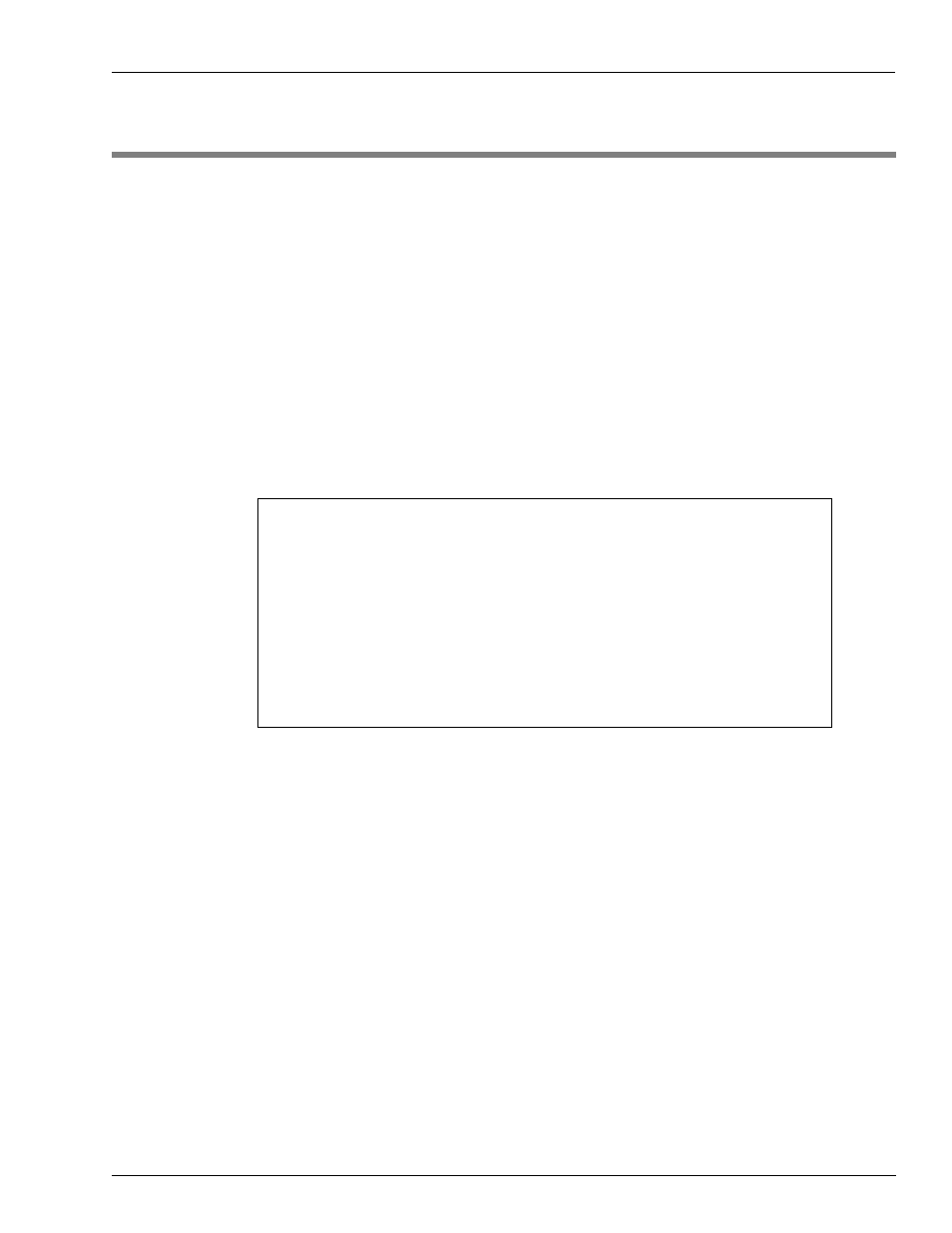

is a sample OFFROAD.DTA file.

Figure 12-1: Sample OFFROAD.DTA File

16 Offroad discount product or #,# for separate state & federal

17. Offroad sales tax product

22.0 Cents/gallon State road tax

20.1 Cents/gallon Federal road tax

8.2 State sales tax rate

Y Y = Allow operator to choose if sales tax applied

N Y = Always, Q = Ask: Add federal road tax to final total

N Y = Always, Q = Ask: Add state tax (if no sales tax) to total

Joe's Filler Up

Mail: P. O. Box 43345

Seattle, WA 98124-1991

>23404 54th St, Fife WA<

(206) 555-1212

Off Road Fuel Receipt

1

Open OFFROAD.DTA in the directory C:\SC3\ (or enter the command FRED

OFFROAD.DTA in the SC3 command window).

2

Offroad discount product or #,# for separate state & federal: Enter the product number(s)

offroad discounts are assigned to.

3

Offroad sales tax product: Enter the product number the offroad sales tax is assigned to.

4

Cents/gallon State road tax: Enter the current amount, in cents, of the state road tax per

gallon.

5

Cents/gallon Federal road tax: Enter the current amount, in cents, of the federal road tax per

gallon.

6

State sales tax rate: Enter the percentage rate for the state sales tax. This can only be a

percentage and not a table look up tax.

This tax is independent of any tax loaded in the configuration or the TAX.BIN program and

will not add to any tax totals.

- 216S

- Atlas Fuel Systems Site Prep Manual

- Atlas Technician Programming Quick Ref

- ATC M05819K00X Kits

- Atlas Fuel Systems Owner Manual

- Gilbarco Global Pumping Unit Operation Manual

- 26

- 26

- 26

- 26

- 620 Series

- Atlas Valve Replacement Kits

- Atlas Fuel Systems Installation Manual

- 9120K

- 9820K

- Atlas Single Std. Inlet Centering Kit

- 8800 Atlas

- 9120K Series Service Manual

- 9800A Atlas

- 9800 Atlas

- 9800 Atlas

- M08400

- 9100 Series

- 9820K Series Installation

- 9853K

- 9216KTW

- Recommended Spare Atlas

- DEF Atlas

- 9820K Series

- 9800Q

- Q Series

- 8753E

- 9152AXTW2

- 8800E

- 8800E

- 9820Q Series

- Atlas Start-up

- 2600A

- 2600A

- 9800Q Front Load Vapor

- 9800Q Front Load Vapor

- 215A

- 9800A

- 9820A

- 2600A

- 216A

- 215A

- 9800Q Vapor

- 9800Q Vapor

- Lamp Kit

- 9120Q Pulser

- 9120Q Series

- 9820Q

- Electric Keytrol

- 9700E

- 9100A

- 5300A

- 553A Series

- Atlas Retail Series

- 9820Q ASTRA

- 9820Q ASTRA

- 9100Q Series

- 2600A High Hose Retriever Kit

- 2600A High Hose Retriever Kit

- 9820A

- 2600A High Hose Retriever Kit

- 2600A High Hose Retriever Kit

- 9800A Series

- 9800A Series

- 8700Q Series

- XU2A

- Q

- 580 Pulser

- 9800Q Series Diagnostic Manual

- 9800Q Series

- 7520 Pulser

- 9820

- 2620

- Blackmer GDP

- Vapor Recovery Kit

- 9800A Totalizer Kit

- 9800 Single

- RS-485 Interface Kit

- 240VAC Heater Kit

- 9800 Rear Totalizer Kit

- 240VAC Fluorescent Light Kit

- EQ 25 XXX

- M04230K00X

- Kit M04477K001

- Totalizer Retro

- M06245K0XX

- Atlas Discharge

- 9800K

- 9800K

- Cold Weather External Filter Upgrade Kit

- Hi-Flow Sat Pipng Conversion Kits

- NPT Disch Kit

- External Filter

- M06430K00X

- M06699KXXX

- Atlas Rain Baffle Air Gap Kit

- Battery Heater Kits

- Hand Drive Kit

- Ultra-Hi Mech Totalizer Kit

- M06875K00X

- Submersible Drv Relay Kit

- 9820K Totalizer Kit

- 9823K Vapor Rcvry Kit

- 9X20 AST Adapter Kit

- 03908X

- 52 Pressure Regulator Valve

- M12158A004

- 900 Series

- M14142K001

- M06184K00X

- Cenex

- Gilbarco Interface Unit

- M09677B015

- FiPay Server Retrofit Kit for 8-hose Islander

- Link Printer

- 1000 Series FMS Cardless Manual

- 1000 Series FleetKey FMS Operation Manual

- 1000 Series FleetKey FMS Operation Manual

- 1000 Series FleetKey FMS Operation Manual

- 1000 Series FleetKey FMS Operation Manual

- 1000 Series FleetKey FMS Operation Manual

- CFN Site Controller

- CFN Series CFN II Quick Reference

- Hard Drive

- Star Printer Controller PCB

- SCII CPU PCB

- CFN Series SCII Installation Manual

- ICR Power Supply Replacement

- Islander Internal Modem

- Islander 4-Hose PCU

- Islander 4-Hose PCU

- ME-800 SHM

- Verifone PIN Pad

- C05899

- C05899

- SCII

- CFN Islander II

- CFN Islander II

- RPS Card Handler

- Gascard Credit

- EDS-CCIS Credit

- Wayne CAT Interface

- Sinclair Credit

- Unitec Interface

- PIN Pad-CFN III

- CFN RPS Card Handler

- MasterCard Fleet Card Handler

- Datacard

- Dial 001

- Attendant Card Handler 2003

- Card Limit Card Handler

- SCIII POS

- Shell Go Card Handler

- ICR Display

- Profit Point

- Profit Point

- Cabling

- Islander II Floppy Drive

- CFN Islander II w/Key

- Profit Point Power Supply

- SCIII Board Set

- Islander Card Reader Retrofit

- CFN Series Profit Point PLUS

- FleetCor Dual Special Card Handler

- CFN Series Site Controller III

- CFN III Configuration Manual

- CFN Series CFN III Configuration Manual V3.6

- CFN Series CFN III Configuration Manual V3.6

- CFN Series Diagnostic Manual

- CFN Series Gilbarco CRIND PC Interface for Site Controller III

- DLL2020 Scanner

- CFN III Mgnr's Mnl V3.4

- CFN III Mgnr's Mnl V3.4

- GL3 V1.4.0.0 and Late

- GL3 V1.4.0.0 and Late

- Voyager Special Card Handler

- CFN III Quick Reference Guide v3.4

- CFN III Quick Reference Guide v3.4

- Site Controller III Start-Up

- Site Controller II CPU

- WEX Special Card Handler

- ADDS 4000

- Dorio 10

- MS7120 Bar Code Scanner Setup

- CFN Series Tokheim Pump PC Interface

- Buypass

- EFS Trking Fuel Mgmnt

- CFN Series Gilbarco Pump PC Interface

- PIN Calculator

- CFN Series Unitec PC Interface

- Quarles NBS

- Current Loop Driver Ferrite

- CFN III Payment Application Best Practices Implementation Requirements

- PA03660XXX

- CFN III V3.6 and Later

- CFN III Fuel Management System PA-DSS

- CFN Series Site Controller III Start-up Manual V3.6

- CFN Series Site Controller III Start-up Manual V3.6

- CFN III Cancel Transaction Decal

- Islander II Spare Parts Kit

- CFN III Manager Manual V3.6

- CFN III Manager Manual V3.6

- Fuel Point

- Putprice command default

- 600 Series Nozzle Boot

- 2020

- VT 520

- 4860 Series Meter

- 1800 Series

- CFN Islander

- 26 Series

- 580

- M08781K001

- 1800 Series Installation

- 580 Series

- 1000 Series FMS Startup Manual

- 1000 Series FMS Card Encoding Manual

- 1000 Series Technical Reference Manual

- 1000 Series Installation

- 1000 Series to FleetKey Conversion Manual

- 1000 Series Field Installation Internal Modem

- 1000 Series Field Installation Internal Modem

- 1000 Series Installing System ROM Chip

- 1000 Series Shift Register Selections

- 1000 Series FMS Diagnostic Manual

- 1000 Series TopKAT Report Printer

- 1000 Series Fuel Management System Installation

- TopKAT Operation Manual

- TopKAT on Pedestal Installation

- TopKAT on Pedestal Installation

- TopKAT Online Operation Manual

- TopKAT PLUS Bypass Switch Installation

- MCE300

- 4-Hose PCU

- MCE300 Program Instructions

- CFN Series

- Magnetic Card Encoder

- Fuel Point-Swivel Limit Bracket

- Swivel Limit

- Fuel Point Dispenser

- Fuel Point-Special Hose

- Fuel Point Reader

- Fuel Point Vehicle Module

- Fuel Point Ground Antenna

- FMS KE200

- Enhanced Communications

- WGT Outdoor Unit

- Tag Reader

- Fuel Truck Controller

- CFN Plus

- FuelOmat Payment Terminal

- SiteOmat Users Manual

- ICR PLUS

- Fuel Point PLUS Station

- SiteOmat Maintenance Manual

- SiteOmat Data Downloader

- FuelOmat system 8 Popt Commverter

- FiPay Payment Network

- Fuel Point PLUS Vehicle

- TopKAT PLUS

- FHO Pods

- Fleet Head Office System

- Fleet PLUS

- Fleet PLUS Rev C

- 1820RCSS